Digital Business Models For Health Insurance

|

| Digital Business Models |

A business model describes the resources, processes and cost assumptions that an organization makes that will lead to the delivery of a unique value proposition to a customer.

Digital And Connected healthcare

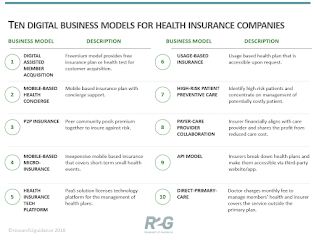

Ten digital business models for health insurance

- Digital

assisted member acquisition

- Mobile based

health concierge

- P2P

Insurance

- Mobile based

micro insurance

- Health

insurance tech platform

- Usage based

insurance

- High risk

patient preventive care

- Payer care

provider collaboration

- API Model

- Direct primary care

Digital technologies will transform the health insurance business and early adopters have started to implement new digital business models with initial success, according to a new Research2Guidance report. The report reveals new digital models are changing the way the insurers interact with patients.

For example, digital insurers have reworked the trust equation with the patient, outsourced much of their value chain to their members, and now know much more about them. Digital business models tend to also blur the lines between payer and caregiver organizations. Some of the first-movers already crossed the line and started to offer services which have previously been provided exclusively by doctors and nurses.

The ten disruptive digital business models that will transform the health insurance business are defined as follows:

1. Digitally assisted member acquisition is a freemium business model concept.

2. Mobile health concierge is a business approach designed for members to complete all health insurance tasks using mobile phones with the support from a concierge team.

3. Peer-to-peer (P2P) insurance refers to a risk-sharing community.

4. Mobile micro-insurance refers to the health insurance plans that cover short-term small health events or minimal ongoing health insurance.

5. Health insurers tech platforms license their technology for the management of health plans and members to their customers.

6. On-demand insurance is a usage-based model that enables members to access desired health plans upon request with the help of a mobile app.

7. High-risk patient preventive care model concentrates on insuring and managing potentially costly patient groups.

8. The payer & provider collaboration model stands for a closer, digitally enabled partnership between payers and care providers, especially hospitals.

9. The API health insurance model uses a list of pre-defined health insurance products accessible to websites and app providers via an application programming interface (API).

10. Direct primary care model. Within this model, a care provider or a hospital act like a health insurance company using a monthly subscription model.

Advantages of a Network Management System:

There are innumerable benefits in developing a

robust healthcare provider network management system. Below are some specifics:

●

Easy and quick access to numerous

options for healthcare

●

Increased affordability toward

health care provision

●

Leading edge in current and

emerging markets

●

Greater transparency in pricing

●

Higher quality of service

A robust healthcare provider network management system enables:

●

Mobility toward caregiving

●

Connects the ecosystem of clinics,

doctors, hospitals and patients

●

Creates a functional platform for

new models

●

Safeguards patient information and

data

●

Enables high quality data exchange

through mobile platforms

THE GROWING CHALLENGES

●

Increased Human Error

●

Payment Challenges

●

Security Issues

●

Increased Waste

●

Treatment Unpredictability

●

Limited Data Access

Business Process Automation

Government Intervention and Regulations

Healthcare Document Management Automation

Health Information Exchanges (HIE)

IoT Automation System Development

AI-Driven Healthcare Automation

HOSPITAL MANAGEMENT AUTOMATION

Fragmentation,

●

disseminated data repository ,high

manual processes and time delays are the issues faced without automation.

●

Enterprise-wide integration of all

networks into a single entity and provide high level of automation.

●

It aids hospital administrators in

improving operational control and streamlining operations.

●

Clinical pathways mapping improve

better diagnosis with good decision support system.

●

Web-enabled customizable solutions

includes patient administration, automated results capture, integrated billing

etc.

REVENUE CYCLE MANAGEMENT

●

To assist in adopting high-quality

electronic billing and payment systems with reduced coding errors

●

Standalone personalized medical

enrollment and billing platform for all healthcare providers.

●

Commercial built-in RCM with

content platform for streamlined reconciliation and increased audit controls.

●

Integrated transitions among the

health information systems and business practices across billing offices

●

Advanced data mining cum dashboard

reporting to analyse remittance and payer issues.

AUTOMATED MEDICAL RECORDS- EHR/EMR/PHR

●

OSP Labs develop HIPAA compliant

EHR / EMR / PHR application software with robust network & secure database.

●

Integration with evidence-based

tools, reliable patient portal and intuitive graphical for desktop and mobile

devices.

●

E-health point solutions utilize

technology to reduce complications, coordination of treatment, and efficient

delivery.

●

With each solution, insurance

payers & can innovate clinical management by improving efficiency and

patient outcome.

Each solution can be integrated independently, or with other point solutions.